Telematics policies, also known as ‘pay how you drive’ or ‘black box’ insurance, are a game-changer in the motor insurance industry. They offer personalized premiums based on how a vehicle is being driven, taking into account various factors like GPS technology to determine a driver’s risk level and set premiums accordingly. Unlike traditional motor insurance policies, which rely on general risk factors like age and location, telematics policies use data collected from the vehicle to offer more tailored coverage.

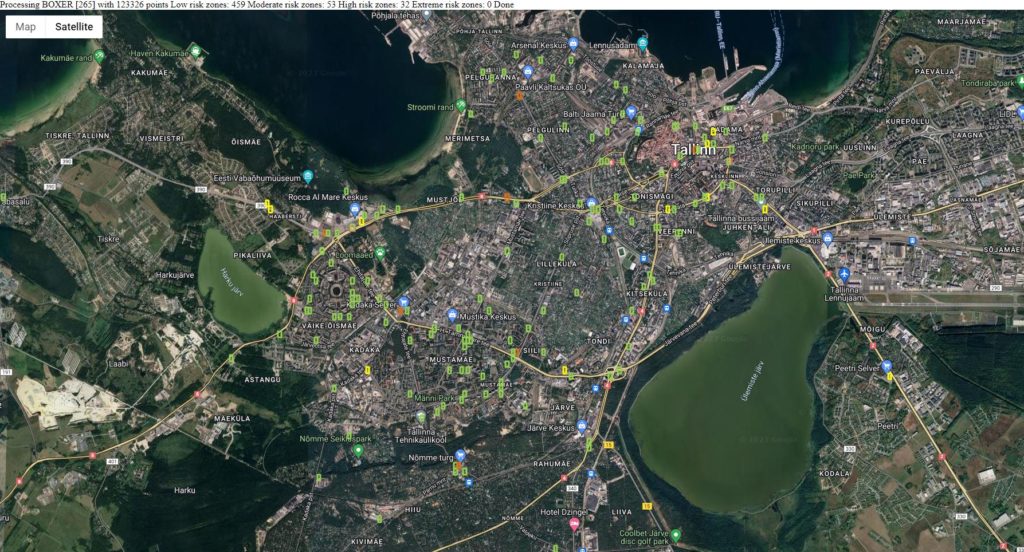

By incorporating GPS technology and analyzing driving patterns, insurers can offer premiums that are more reflective of a driver’s risk level. Factors like the number of miles driven, types of roads used, and driving patterns like speed and braking are analyzed to determine a driver’s level of risk. This way, insurers can offer lower premiums to safe drivers, while those who are considered less safe may pay higher premiums.

Our company specializes in providing innovative models for calculating Pay How You Drive (PHYD) insurance premiums, tailored to your specific needs. We can help you implement a telematics-based motor insurance policy that accurately measures a driver’s performance and offers personalized coverage based on their individual driving habits. We use cutting-edge technology that can be implemented using different technologies, such as a computer built into the vehicle, a small device known as a ‘black box,’ or a smartphone app.

If you’re looking to revolutionize your motor insurance offerings and provide a more accurate and personalized experience for your customers, contact us today to learn more about our services.